Vheip Login

Vheip Login - The vermont higher education investment plan (plan) is sponsored by the vermont student assistance corporation (vsac) and is also marketed under the name vt529. The vermont higher education investment plan (plan) is sponsored by the vermont student assistance corporation (vsac) and is also marketed under the name vt529. Enrollment in the vheip program is completed online: For more information on vheip accounts, see tax credits available to individuals. Download the entity account enrollment form from our. If you already have an account and would like to register for online access, please make sure to have this information ready: Once your account is confirmed, you may submit the vt529 deduction authorization form to begin payroll deductions into your account. We'll help guide you through. Interests in the plan are issued directly to account owners by vsac. Don't know your account number? Opening an account by a trust, estate, business entity, 501 (c) (3) organization, or state or local government or agency? If you already have an account and would like to register for online access, please make sure to have this information ready: We'll help guide you through. For more information on vheip accounts, see tax credits available to individuals. To open an individual account or a custodial account for a minor (ugma/utma), log in to your account online at any time or see our account forms page. Get started with just $25. Don't know your account number? Once your account is confirmed, you may submit the vt529 deduction authorization form to begin payroll deductions into your account. Access vt529 account forms to open, manage, or update your 529 savings. Learn how to claim your vt529 tax credit for 2024. Interests in the plan are issued directly to account owners by vsac. As vermont’s official 529 college savings plan, vheip is the only 529 plan that qualifies for a vermont state income tax credit. For more information on vheip accounts, see tax credits available to individuals. Vt529, formerly vheip, is vermont's college savings program that offers a 10% vt state. Vt529, formerly vheip, is vermont's college savings program that offers a 10% vt state income tax credit on annual contributions. Once your account is confirmed, you may submit the vt529 deduction authorization form to begin payroll deductions into your account. To open an individual account or a custodial account for a minor (ugma/utma), log in to your account online at. For more information on vheip accounts, see tax credits available to individuals. The vermont higher education investment plan (plan) is sponsored by the vermont student assistance corporation (vsac) and is also marketed under the name vt529. Once your account is confirmed, you may submit the vt529 deduction authorization form to begin payroll deductions into your account. Access vt529 account forms. Access vt529 account forms to open, manage, or update your 529 savings. Find contribution, withdrawal, and beneficiary change forms. Learn how to claim your vt529 tax credit for 2024. To open an individual account or a custodial account for a minor (ugma/utma), log in to your account online at any time or see our account forms page. We'll help guide. As vermont’s official 529 college savings plan, vheip is the only 529 plan that qualifies for a vermont state income tax credit. Don't know your account number? Whatever the age of your student, vermont’s 529 college savings plan can help you save, so that education funding will be there when they are ready. Opening an account by a trust, estate,. Interests in the plan are issued directly to account owners by vsac. Enrollment in the vheip program is completed online: Access vt529 account forms to open, manage, or update your 529 savings. The vermont higher education investment plan (plan) is sponsored by the vermont student assistance corporation (vsac) and is also marketed under the name vt529. Vt529, formerly vheip, is. To open an individual account or a custodial account for a minor (ugma/utma), log in to your account online at any time or see our account forms page. Download the entity account enrollment form from our. Vt529, formerly vheip, is vermont's college savings program that offers a 10% vt state income tax credit on annual contributions. If you already have. Find contribution, withdrawal, and beneficiary change forms. To open an individual account or a custodial account for a minor (ugma/utma), log in to your account online at any time or see our account forms page. For more information on vheip accounts, see tax credits available to individuals. The vermont higher education investment plan (plan) is sponsored by the vermont student. Learn how to claim your vt529 tax credit for 2024. Once your account is confirmed, you may submit the vt529 deduction authorization form to begin payroll deductions into your account. Vt529, formerly vheip, is vermont's college savings program that offers a 10% vt state income tax credit on annual contributions. Whatever the age of your student, vermont’s 529 college savings. The vermont higher education investment plan (plan) is sponsored by the vermont student assistance corporation (vsac) and is also marketed under the name vt529. Once your account is confirmed, you may submit the vt529 deduction authorization form to begin payroll deductions into your account. Find contribution, withdrawal, and beneficiary change forms. Learn how to claim your vt529 tax credit for. Don't know your account number? Learn how to claim your vt529 tax credit for 2024. Download the entity account enrollment form from our. Enrollment in the vheip program is completed online: For more information on vheip accounts, see tax credits available to individuals. Interests in the plan are issued directly to account owners by vsac. We'll help guide you through. To open an individual account or a custodial account for a minor (ugma/utma), log in to your account online at any time or see our account forms page. The vermont higher education investment plan (plan) is sponsored by the vermont student assistance corporation (vsac) and is also marketed under the name vt529. As vermont’s official 529 college savings plan, vheip is the only 529 plan that qualifies for a vermont state income tax credit. Access vt529 account forms to open, manage, or update your 529 savings. The vermont higher education investment plan (plan) is sponsored by the vermont student assistance corporation (vsac) and is also marketed under the name vt529. Get started with just $25. Once your account is confirmed, you may submit the vt529 deduction authorization form to begin payroll deductions into your account. Vt529, formerly vheip, is vermont's college savings program that offers a 10% vt state income tax credit on annual contributions.VHEIP Vermont's 529 College Savings Plan

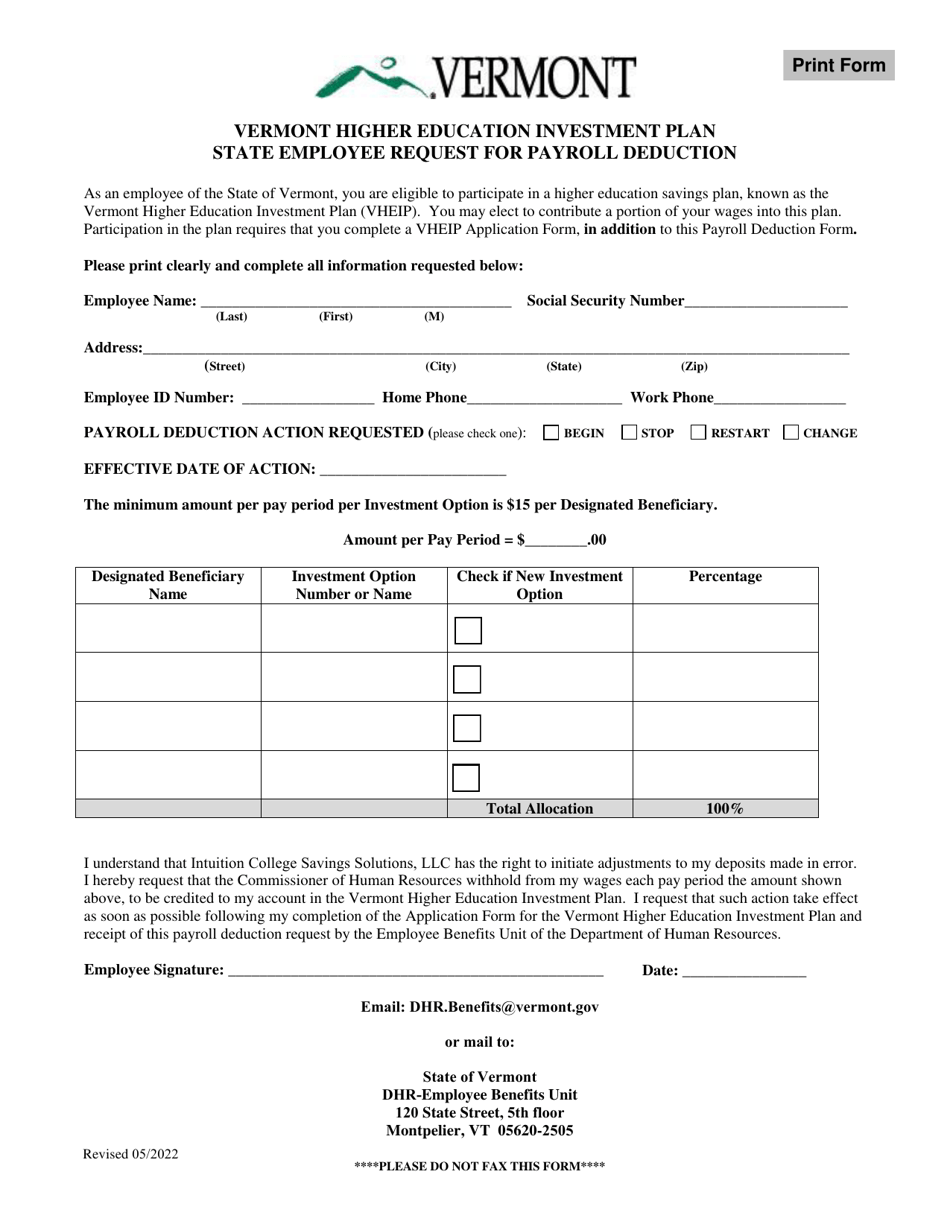

Vermont State Employee Request for Payroll Deduction Vermont Higher Education Investment Plan

Calamba City Higher Education Institutions Association Calamba

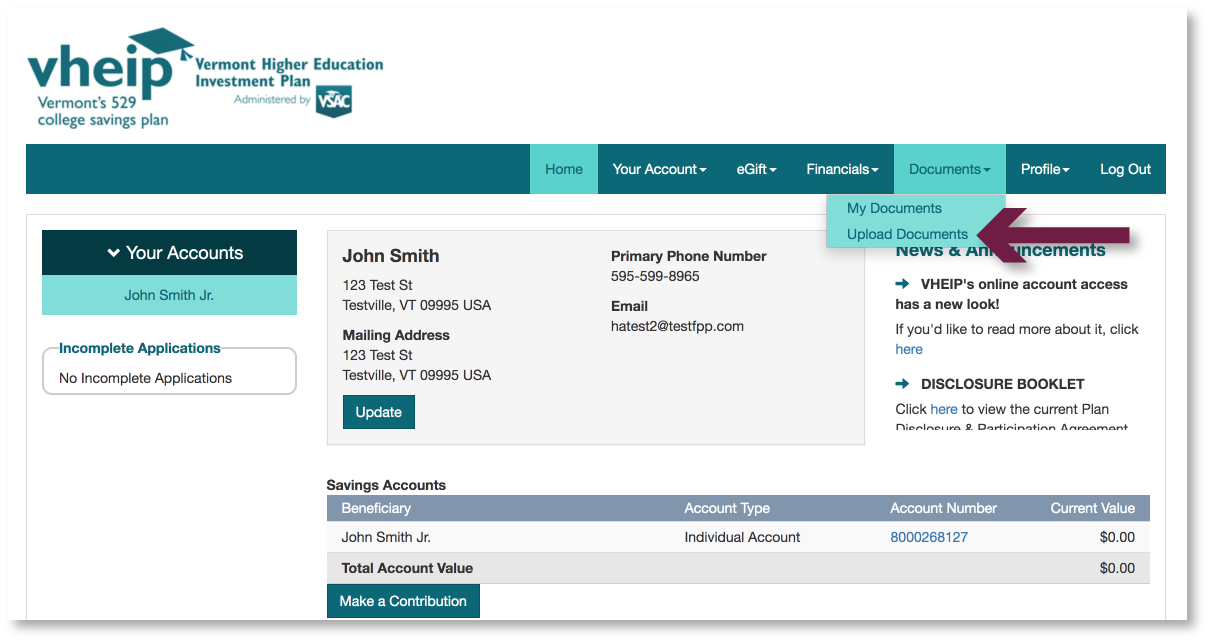

How To's VHEIP

HOW DO I PAY FOR COLLEGE? FUNDING SOURCES “When it comes to saving for college, many parents and

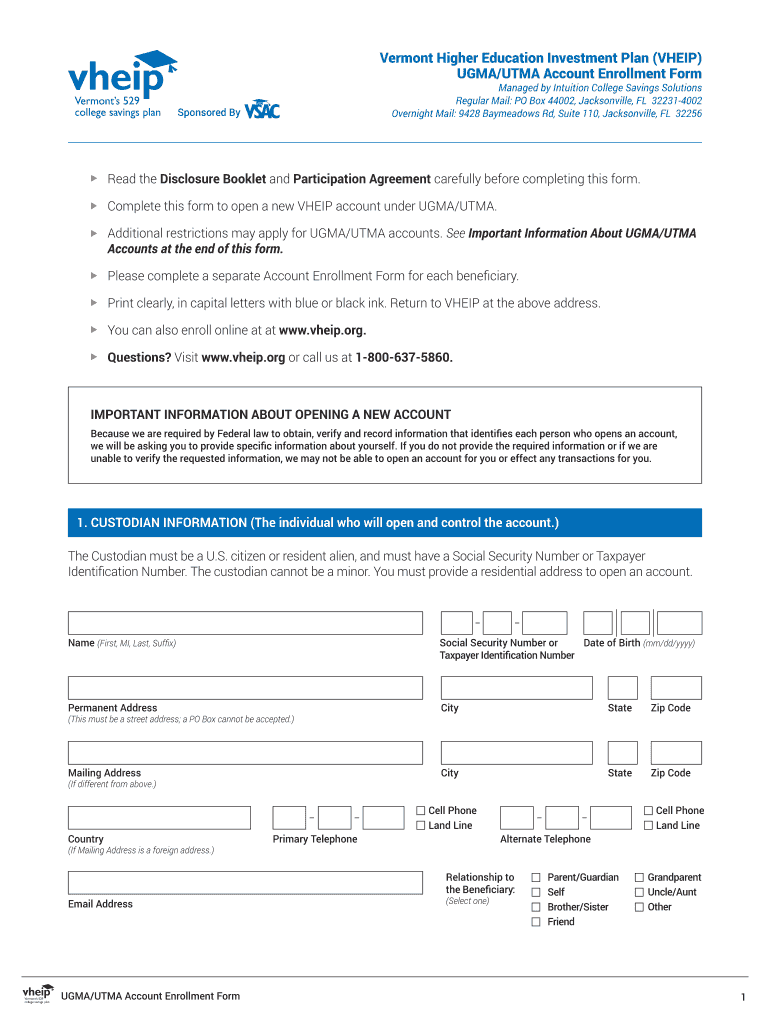

Fillable Online vheip UGMAUTMA Form VHEIP Fax Email Print pdfFiller

Student studying cartoon Stock Vector Images Alamy

Add an Extra Monthly Subscription Plan Virtual Surveyor Support Portal

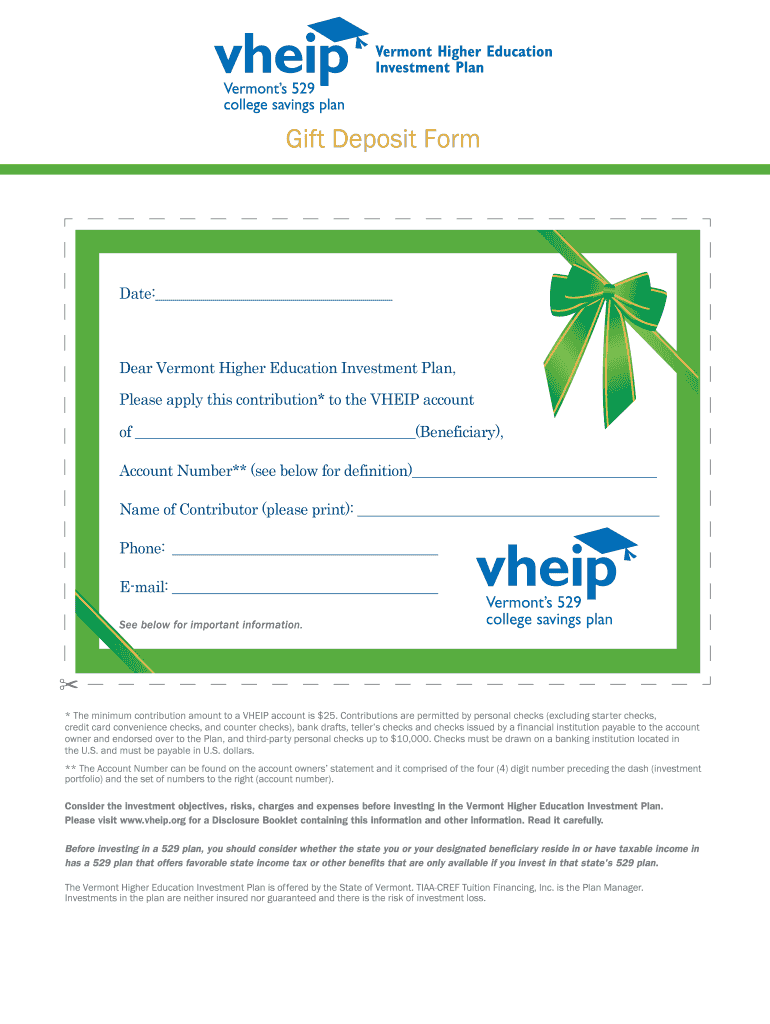

Fillable Online vheip Print a gift deposit form VHEIP Fax Email Print pdfFiller

VSAC Shows You How webinar Saving with a 529 VHEIP

Whatever The Age Of Your Student, Vermont’s 529 College Savings Plan Can Help You Save, So That Education Funding Will Be There When They Are Ready.

If You Already Have An Account And Would Like To Register For Online Access, Please Make Sure To Have This Information Ready:

Opening An Account By A Trust, Estate, Business Entity, 501 (C) (3) Organization, Or State Or Local Government Or Agency?

Find Contribution, Withdrawal, And Beneficiary Change Forms.

Related Post: