Ownwell Login

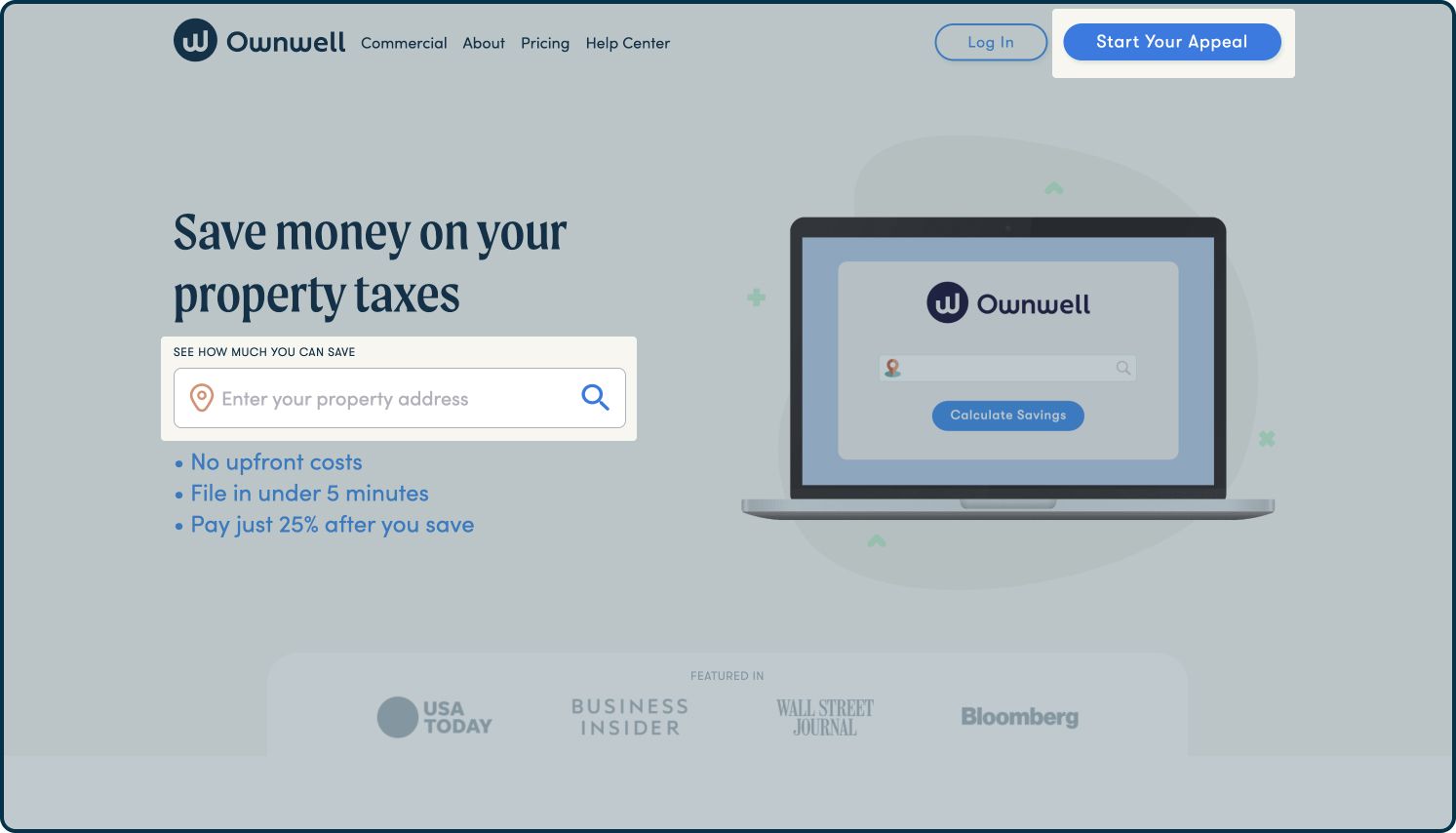

Ownwell Login - This guide will walk you through everything you need to know about the ownwell official website, including how to log in, contact support, and access tools to potentially save thousands on your property taxes. Navigate to our claim account page directly at ownwell.com/claim. Enter the email address you used when signing up your property. How often does ownwell save homeowners money? Ownwell is a service that can help you reduce the amount you pay in property taxes. Or click “sign in” in the ownwell.com header, navigate to the bottom of the page, and click “claim account”. Sign up for our free monthly digest powered by ownwell to receive a snapshot of your home's value, your equity position, your current mortgage product's effectivness and your potential buying power. If you own multiple properties, you can add each address in and manage everything from the same login. Once in your portal, click on “account” in the navigation on the left side of the page, towards the bottom. First, you sign up (it’s free) you basically create a profile, and fill out information about the property you own. Enter the email address you used when signing up your property. If you own multiple properties, you can add each address in and manage everything from the same login. In the account information section, enter your old password along with your new password. Once in your portal, click on “account” in the navigation on the left side of the page, towards the bottom. Ownwell is a service that can help you reduce the amount you pay in property taxes. We want you to know! Sign up for our free monthly digest powered by ownwell to receive a snapshot of your home's value, your equity position, your current mortgage product's effectivness and your potential buying power. On average in 2022, 86% of homeowners who signed up with ownwell saved money on their property taxes. It's currently only available in california, florida, georgia, illinois, new york, texas, and washington. Or click “sign in” in the ownwell.com header, navigate to the bottom of the page, and click “claim account”. #ownwell #ownwellreviews #ownwellcomownwell com reviews [ with proof scam or legit ? This guide will walk you through everything you need to know about the ownwell official website, including how to log in, contact support, and access tools to potentially save thousands on your property taxes. Ownwell is a service that can help you reduce the amount you pay in. How often does ownwell save homeowners money? #ownwell #ownwellreviews #ownwellcomownwell com reviews [ with proof scam or legit ? We want you to know! Once in your portal, click on “account” in the navigation on the left side of the page, towards the bottom. First, you sign up (it’s free) you basically create a profile, and fill out information about. Sign in to ownwell to unlock your personalized property tax dashboard. Navigate to our claim account page directly at ownwell.com/claim. How often does ownwell save homeowners money? If you own multiple properties, you can add each address in and manage everything from the same login. Stay updated with monthly home price estimates. We want you to know! How often does ownwell save homeowners money? Once in your portal, click on “account” in the navigation on the left side of the page, towards the bottom. It's currently only available in california, florida, georgia, illinois, new york, texas, and washington. Sign up for our free monthly digest powered by ownwell to receive a snapshot. On average in 2022, 86% of homeowners who signed up with ownwell saved money on their property taxes. Sign in to ownwell to unlock your personalized property tax dashboard. How often does ownwell save homeowners money? Once in your portal, click on “account” in the navigation on the left side of the page, towards the bottom. #ownwell #ownwellreviews #ownwellcomownwell com. Access custom savings opportunities, manage your protests, and optimize your property tax strategy today. #ownwell #ownwellreviews #ownwellcomownwell com reviews [ with proof scam or legit ? If you own multiple properties, you can add each address in and manage everything from the same login. Sign up for our free monthly digest powered by ownwell to receive a snapshot of your. Or click “sign in” in the ownwell.com header, navigate to the bottom of the page, and click “claim account”. Navigate to our claim account page directly at ownwell.com/claim. Enter the email address you used when signing up your property. Once in your portal, click on “account” in the navigation on the left side of the page, towards the bottom. This. Ownwell is a service that can help you reduce the amount you pay in property taxes. #ownwell #ownwellreviews #ownwellcomownwell com reviews [ with proof scam or legit ? If you own multiple properties, you can add each address in and manage everything from the same login. Sign up for our free monthly digest powered by ownwell to receive a snapshot. Ownwell combines mortgage and client data from your submission platform or crm, home price estimates from one of canada’s top housing data providers, and rates from lender spotlight to generate insights on your clients' home equity and mortgage options. Ownwell is a service that can help you reduce the amount you pay in property taxes. We want you to know!. How often does ownwell save homeowners money? Once in your portal, click on “account” in the navigation on the left side of the page, towards the bottom. Access custom savings opportunities, manage your protests, and optimize your property tax strategy today. Ownwell is a service that can help you reduce the amount you pay in property taxes. First, you sign. Ownwell combines mortgage and client data from your submission platform or crm, home price estimates from one of canada’s top housing data providers, and rates from lender spotlight to generate insights on your clients' home equity and mortgage options. On average in 2022, 86% of homeowners who signed up with ownwell saved money on their property taxes. It's currently only available in california, florida, georgia, illinois, new york, texas, and washington. Sign up for our free monthly digest powered by ownwell to receive a snapshot of your home's value, your equity position, your current mortgage product's effectivness and your potential buying power. How often does ownwell save homeowners money? Navigate to our claim account page directly at ownwell.com/claim. In the account information section, enter your old password along with your new password. Stay updated with monthly home price estimates. Enter the email address you used when signing up your property. Ownwell is a service that can help you reduce the amount you pay in property taxes. If you own multiple properties, you can add each address in and manage everything from the same login. #ownwell #ownwellreviews #ownwellcomownwell com reviews [ with proof scam or legit ? Or click “sign in” in the ownwell.com header, navigate to the bottom of the page, and click “claim account”. Access custom savings opportunities, manage your protests, and optimize your property tax strategy today. Once in your portal, click on “account” in the navigation on the left side of the page, towards the bottom.Ownwell Property Tax Review Simplifying Your Tax Management Experience The Fintech Mag

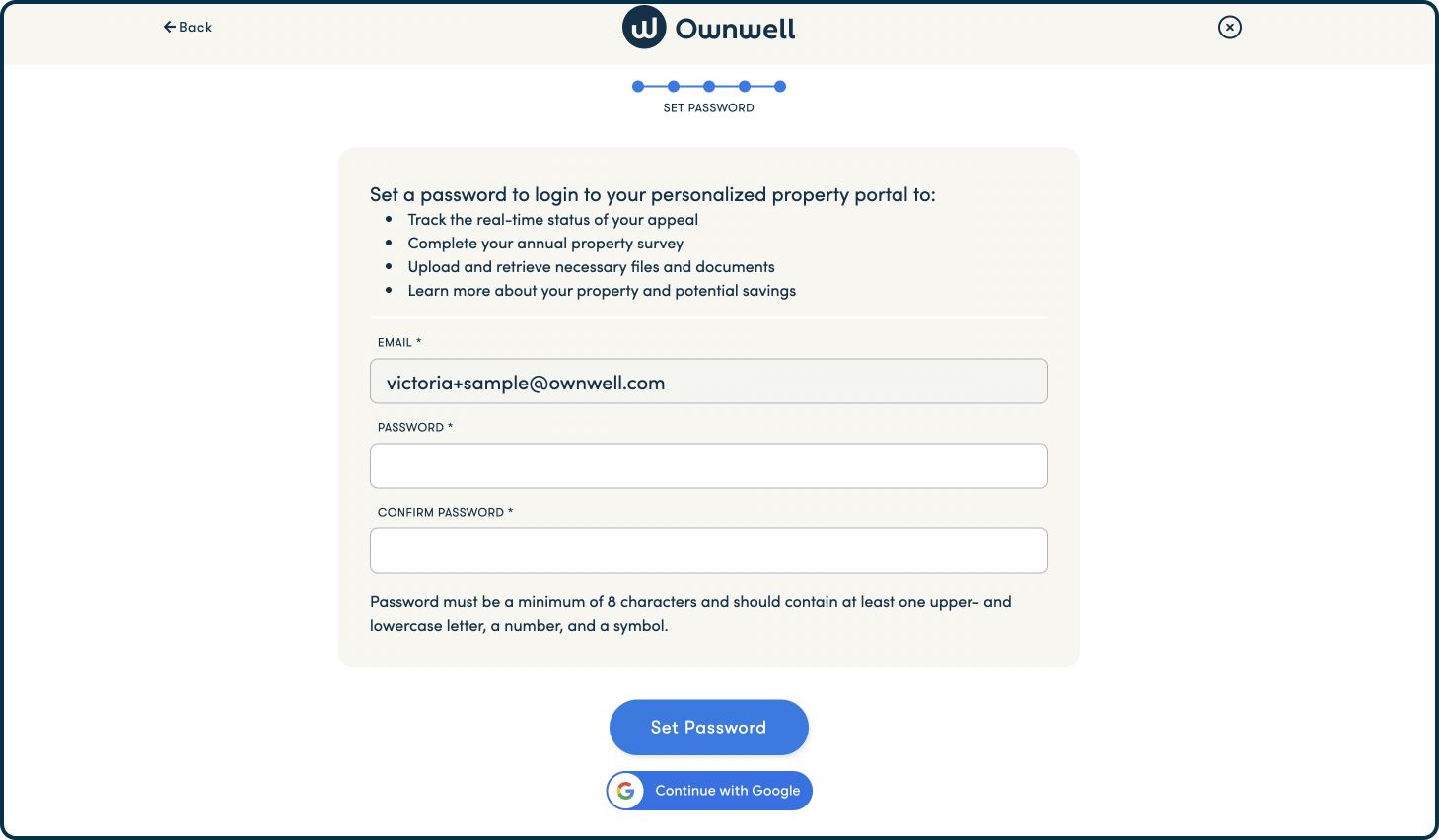

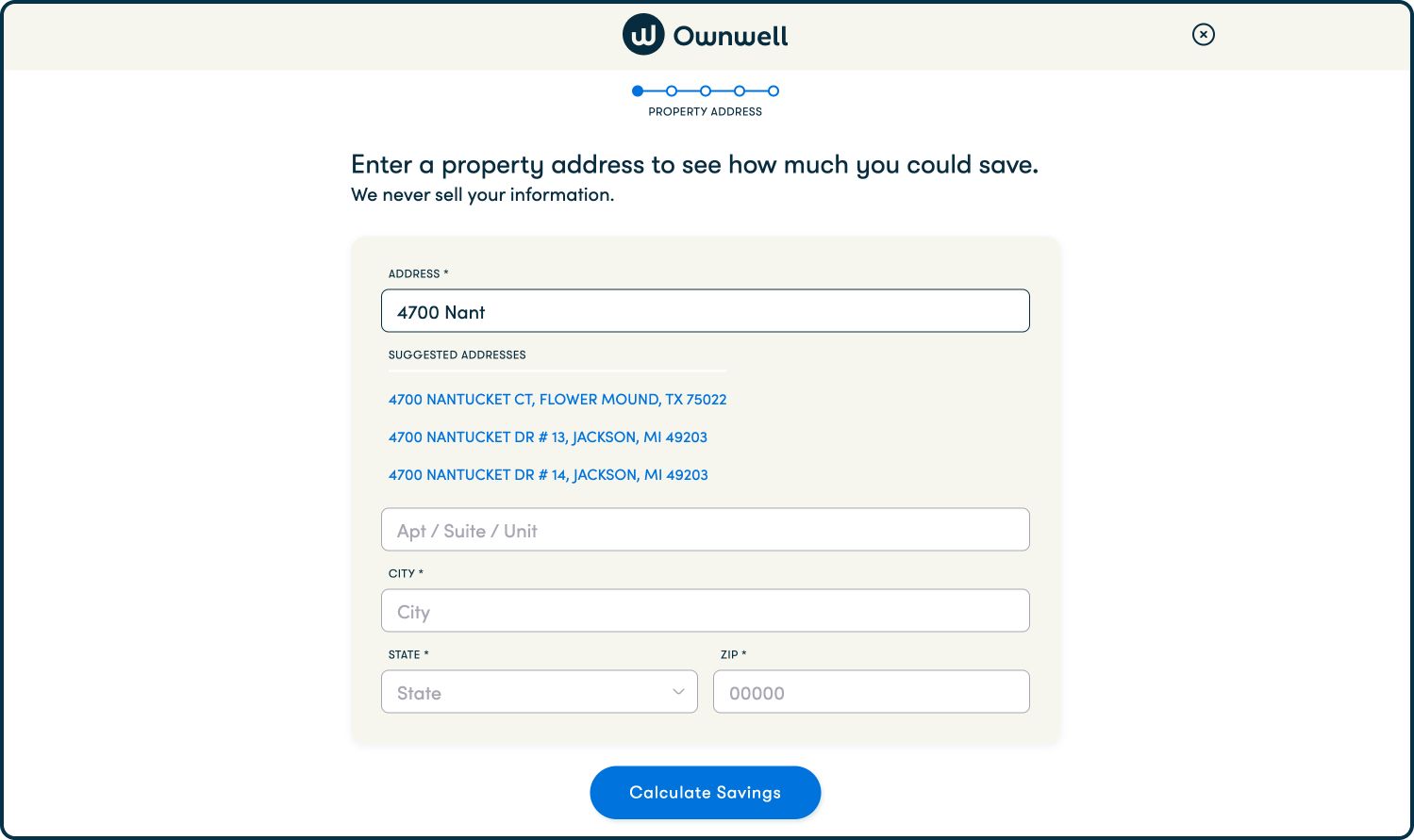

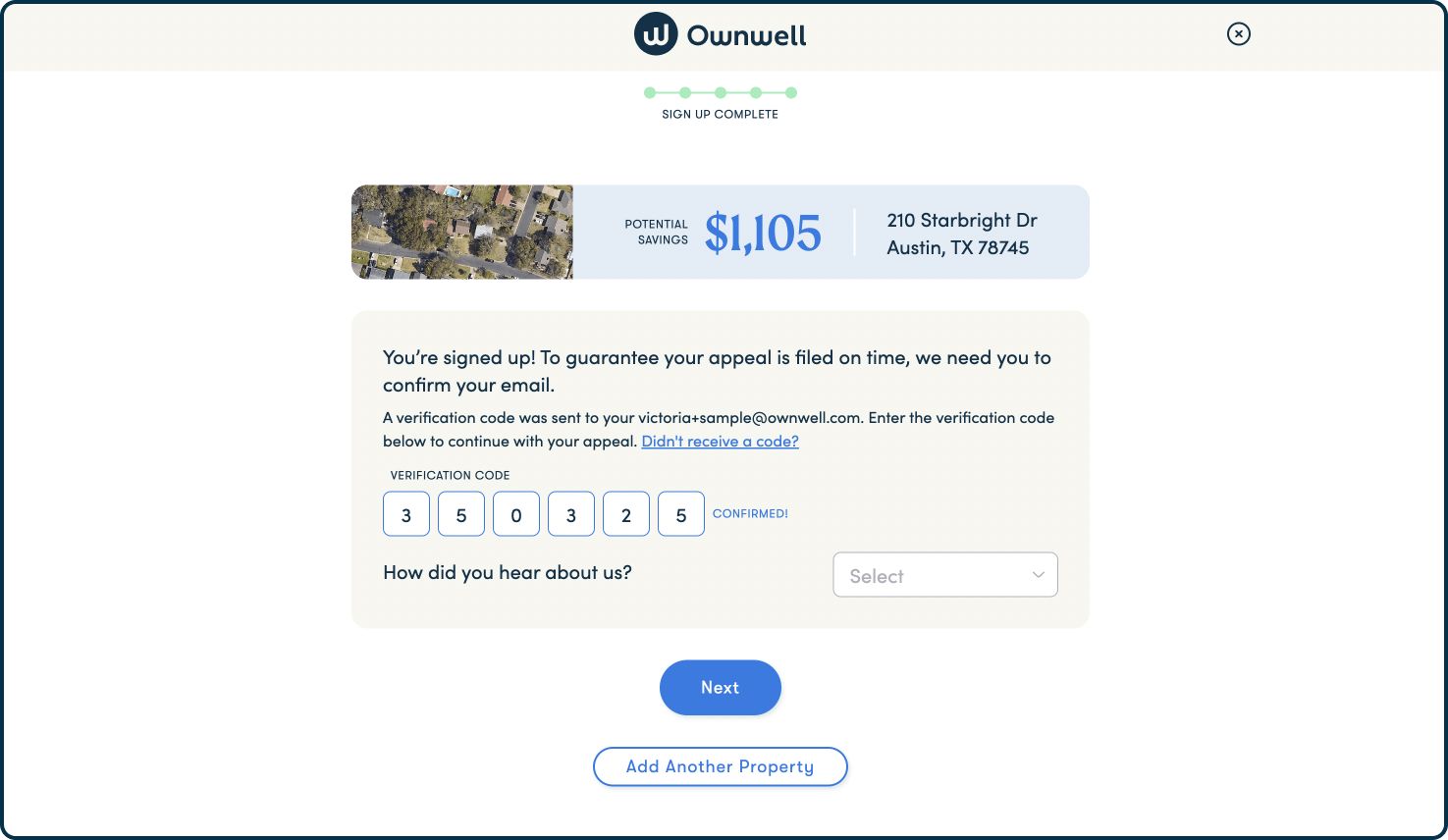

How do I sign up to appeal my property with Ownwell?

Ownwell Reviews 5 Reviews of Sitejabber

How do I sign up to appeal my property with Ownwell?

Ownwell Property Tax, Wiki, Company Profile, Logo Deshi Companies

New Name. Same Fast & Simple Property Tax Appeals.

How do I sign up to appeal my property with Ownwell?

Ownwell Careers Levels.fyi

How do I sign up to appeal my property with Ownwell?

Ownwell bioteknisk städning i vardagen

We Want You To Know!

This Guide Will Walk You Through Everything You Need To Know About The Ownwell Official Website, Including How To Log In, Contact Support, And Access Tools To Potentially Save Thousands On Your Property Taxes.

Sign In To Ownwell To Unlock Your Personalized Property Tax Dashboard.

First, You Sign Up (It’s Free) You Basically Create A Profile, And Fill Out Information About The Property You Own.

Related Post: