Dor Payment Card Login

Dor Payment Card Login - Customers who receive a tax bill or warrant can make a secure payment to the indiana department of revenue (dor) using intime without the need to sign up or log in. The caldor payment card is the property of dor. Select bank payment (no fee) or credit card (fee). Implementation of the vrc portal began in january 2021 and will continue to expand to serve the needs of dor consumers, vendors, and staff. You can pay your oregon taxes by phone or online using your credit or debit card. You can pay any invoice or accounts receivable with the dor payment portal. Need to make an estimated payment in gtc? How do you login to your account? There is an additional convenience fee charged by mississippi interactive. Pay a bill through intime. How do you login to your account? Customers who receive a tax bill or warrant can make a secure payment to the indiana department of revenue (dor) using intime without the need to sign up or log in. Need to make an estimated payment in gtc? Beginning with the 2024 tax year, taxpayers should use louisiana taxpayer access point. To pay online, you need to have an account set up with revenue online or a tax return filed in oregon. Please login with your business identification number/account id and pin to view the company id for the oregon department of revenue. Dor’s consumers can go out and purchase what they need with their new card once the authorized funds are loaded to their account, while controls and data collection give. Instructions and details can be found on the paper that your card came with that can help you figure out your username and pw to log in. You cannot make payments to any other california state agency other than dor and all payments must be in. Upon my dor case closure or by request of the department, my caldor payment card account will be inactivated. How do you login to your account? Upon my dor case closure or by request of the department, my caldor payment card account will be inactivated. Access the cpc participant portal to check balances, receive notifications, and upload receipts. Learn how to enroll and use the caldor payment card, a new method to pay for authorized goods and services for. Learn how to download and use the dor cpc app on your iphone, ipad or android device. Instructions and details can be found on the paper that your card came with that can help you figure out your username and pw to log in. Access the cpc participant portal to check balances, receive notifications, and upload receipts. Pay a bill. Pay a bill through intime. Learn how to download and use the dor cpc app on your iphone, ipad or android device. Instructions and details can be found on the paper that your card came with that can help you figure out your username and pw to log in. Payment for unpaid income tax”. How do you login to your. Learn how to download and use the dor cpc app on your iphone, ipad or android device. Payment for unpaid income tax”. To pay online, you need to have an account set up with revenue online or a tax return filed in oregon. You cannot make payments to any other california state agency other than dor and all payments must. You can pay any invoice or accounts receivable with the dor payment portal. Payment for unpaid income tax”. Make the most of your caldor payment card account by quickly checking your authorized vocational rehabilitation goods and services fund balances and details, uploading. You can pay your oregon taxes by phone or online using your credit or debit card. Customers who. Implementation of the vrc portal began in january 2021 and will continue to expand to serve the needs of dor consumers, vendors, and staff. Upon my dor case closure or by request of the department, my caldor payment card account will be inactivated. Learn how to enroll and use the caldor payment card, a new method to pay for authorized. Instructions and details can be found on the paper that your card came with that can help you figure out your username and pw to log in. Pay a bill through intime. You can pay any invoice or accounts receivable with the dor payment portal. Learn how to enroll and use the caldor payment card, a new method to pay. Locate the “payments” panel and click on “make a payment.” go to the “bill payments” panel. Electronic payments can be made using aztaxes.gov under the “make an individual/small business income payment” and selecting “liability: To pay online, you need to have an account set up with revenue online or a tax return filed in oregon. How do you login to. There is an additional convenience fee charged by mississippi interactive. Implementation of the vrc portal began in january 2021 and will continue to expand to serve the needs of dor consumers, vendors, and staff. How do you login to your account? Need to make an estimated payment in gtc? To pay online, you need to have an account set up. Please login with your business identification number/account id and pin to view the company id for the oregon department of revenue. Upon my dor case closure or by request of the department, my caldor payment card account will be inactivated. You can pay any invoice or accounts receivable with the dor payment portal. Select bank payment (no fee) or credit. Need to make an estimated payment in gtc? Implementation of the vrc portal began in january 2021 and will continue to expand to serve the needs of dor consumers, vendors, and staff. Select bank payment (no fee) or credit card (fee). Instructions and details can be found on the paper that your card came with that can help you figure out your username and pw to log in. How do you login to your account? You can pay any invoice or accounts receivable with the dor payment portal. Pay a bill through intime. You can pay your oregon taxes by phone or online using your credit or debit card. Payment for unpaid income tax”. Dor’s consumers can go out and purchase what they need with their new card once the authorized funds are loaded to their account, while controls and data collection give. Locate the “payments” panel and click on “make a payment.” go to the “bill payments” panel. Beginning with the 2024 tax year, taxpayers should use louisiana taxpayer access point. Electronic payments can be made using aztaxes.gov under the “make an individual/small business income payment” and selecting “liability: There is an additional convenience fee charged by mississippi interactive. Use the payment history button to cancel pending. Please login with your business identification number/account id and pin to view the company id for the oregon department of revenue.Alfardan Exchange MasterCard Cash Passport Platinum Card Alfardan Exchange

Payment by Dor on Dribbble

www.mydorway.dor.sc.gov South Carolina Sales Tax Payment

CPC CA Department of Rehabilitation

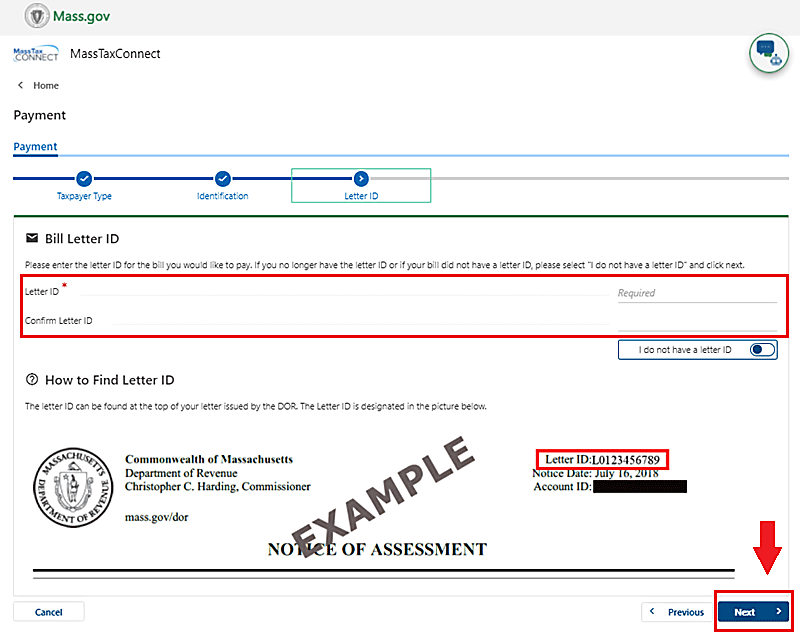

DOR Notices and Bills Mass.gov

Payment by Dor on Dribbble

How To Login Old Navy Credit Card Online Account 2022 Old Navy Credit Card Sign In Help YouTube

Take a peek at the My DOR upgrade Washington Department of Revenue

Alfardan Exchange MasterCard Cash Passport YouTube

CPC CA Department of Rehabilitation

Find Out How To Sign In, Change Your Password, Answer Security Questions And Access Your Account.

Customers Who Receive A Tax Bill Or Warrant Can Make A Secure Payment To The Indiana Department Of Revenue (Dor) Using Intime Without The Need To Sign Up Or Log In.

Learn How To Download And Use The Dor Cpc App On Your Iphone, Ipad Or Android Device.

The Caldor Payment Card Is The Property Of Dor.

Related Post: