Company Login Hmrc

Company Login Hmrc - Check what you owe hmrc; Free company information from companies house including registered office address, filing history, accounts, annual return, officers, charges, business activity Your hmrc business tax account shows a summary of your. File your company’s director or secretary changes and other information; Hmrc's personal tax account (pta) and business tax account (bta) allow you to view and manage your tax affairs online. You have other options for filing your companies. As an employer, you need to use hm revenue and customs’ (hmrc) paye online service to: You can use your hmrc business tax account to: You can use your online tax services to complete tasks like. If you have an existing companies house account, enter your email address. Check your tax position for taxes that you have registered for; Click here to log into your government gateway account. Don’t let this crucial operational. Sign up to get email reminders. What can you do when signed in to companies house webfiling? File your company’s confirmation statement; You will need your government. File your company’s annual accounts; Wondering how to create an hmrc account so you can pay your business and payroll taxes? Your hmrc business tax account shows a summary of your. File your company’s director or secretary changes and other information; From 1 april 2026 you will need to use commercial software to file annual accounts and company tax returns with hmrc. Find out how your business tax account can help you manage all your business taxes online from one sign in. This is the new way to sign in to. Don’t let this crucial operational. Hmrc will close its joint online filing service in march 2026. Free company information from companies house including registered office address, filing history, accounts, annual return, officers, charges, business activity You will need to register for a business tax account at hmrc online services: Company tax return (ct600) for corporation tax with hm revenue and. Company tax return (ct600) for corporation tax with hm revenue and customs (hmrc) accounts with companies house From 1 april 2026 you will need to use commercial software to file annual accounts and company tax returns with hmrc. Once your account is set up and the relevant taxes are registered, you can log in to your business tax account through. If you have an existing companies house account, enter your email address. Use this service to file your company or association’s: This is the new way to sign in to some of our services. Shared workspace is a secure and flexible online service where businesses and hmrc can work and communicate quickly and easily. From one sign in, you can. Sign in with gov.uk one login. If you have an existing companies house account, enter your email address. What can you do when signed in to companies house webfiling? You have other options for filing your companies. Wondering how to create an hmrc account so you can pay your business and payroll taxes? Don’t let this crucial operational. You can use your online tax services to complete tasks like. From one sign in, you can view a summary of your business’s tax position for taxes that you have registered for. You can use your hmrc business tax account to: Hmrc's personal tax account (pta) and business tax account (bta) allow you to view. Once your account is set up and the relevant taxes are registered, you can log in to your business tax account through the hmrc website. If you have an existing companies house account, enter your email address. File your company’s confirmation statement; As an employer, you need to use hm revenue and customs’ (hmrc) paye online service to: You can. A business tax account is an online tax service created by hmrc to help business owners efficiently manage their taxes in one place. Sign in with your organizational account. Add or remove a tax, duty or. You have other options for filing your companies. File your company’s confirmation statement; You have other options for filing your companies. Shared workspace is a secure and flexible online service where businesses and hmrc can work and communicate quickly and easily. You may need to create a new. If you have an existing companies house account, enter your email address. You can use your hmrc business tax account to: You can use your hmrc business tax account to: Shared workspace is a secure and flexible online service where businesses and hmrc can work and communicate quickly and easily. Sign in or set up an account then add corporation tax to the account. Check your tax position for taxes that you have registered for; Hmrc's personal tax account (pta) and. From one sign in, you can view a summary of your business’s tax position for taxes that you have registered for. Check what you owe hmrc; Sign up to get email reminders. You will need your government. Find out more about this service, how to register and. What can you do when signed in to companies house webfiling? Sign in or set up an account then add corporation tax to the account. A business tax account is an online tax service created by hmrc to help business owners efficiently manage their taxes in one place. Don’t let this crucial operational. Company tax return (ct600) for corporation tax with hm revenue and customs (hmrc) accounts with companies house File your company’s director or secretary changes and other information; Sign in with your organizational account. As an employer, you need to use hm revenue and customs’ (hmrc) paye online service to: You may need to create a new. Simply log in to your account and navigate to business services. From 1 april 2026 you will need to use commercial software to file annual accounts and company tax returns with hmrc.Hmrc Login

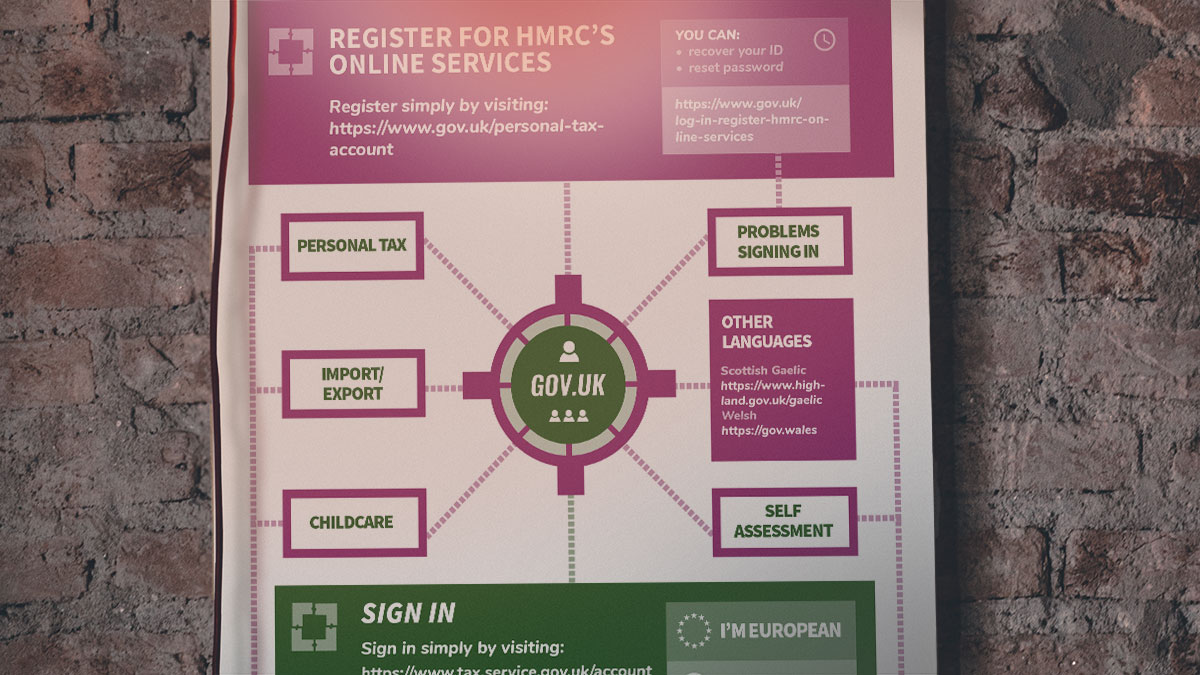

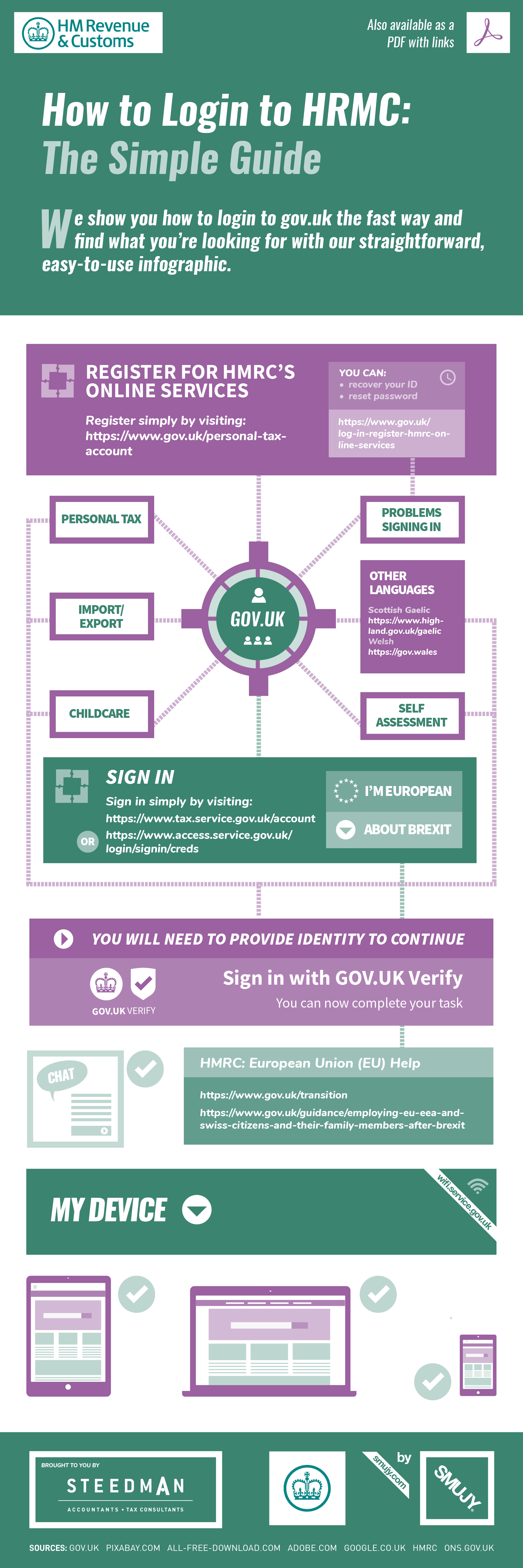

HMRC Login Login HMRC Easily with our Infographic

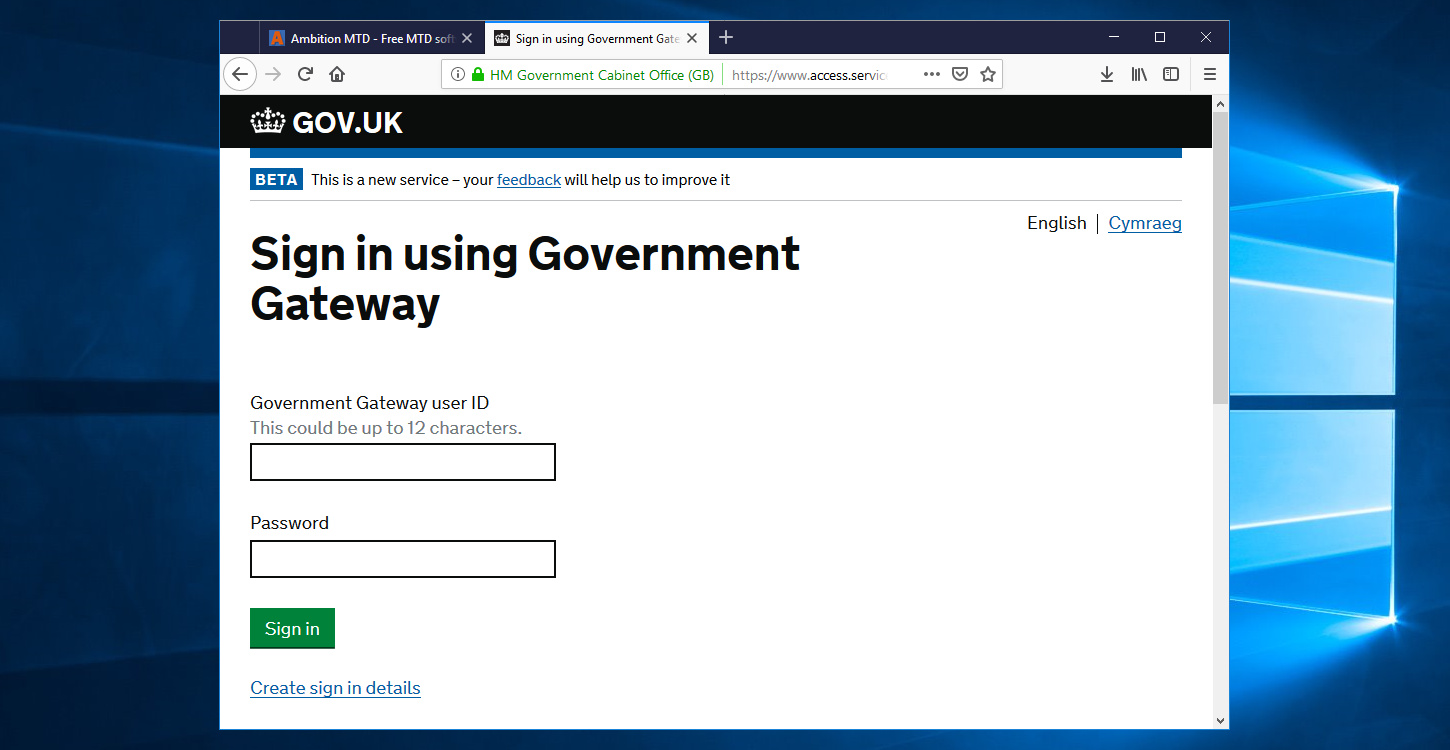

Hmrc Login

How do I file the Tax Return with HMRC Inform Direct Support

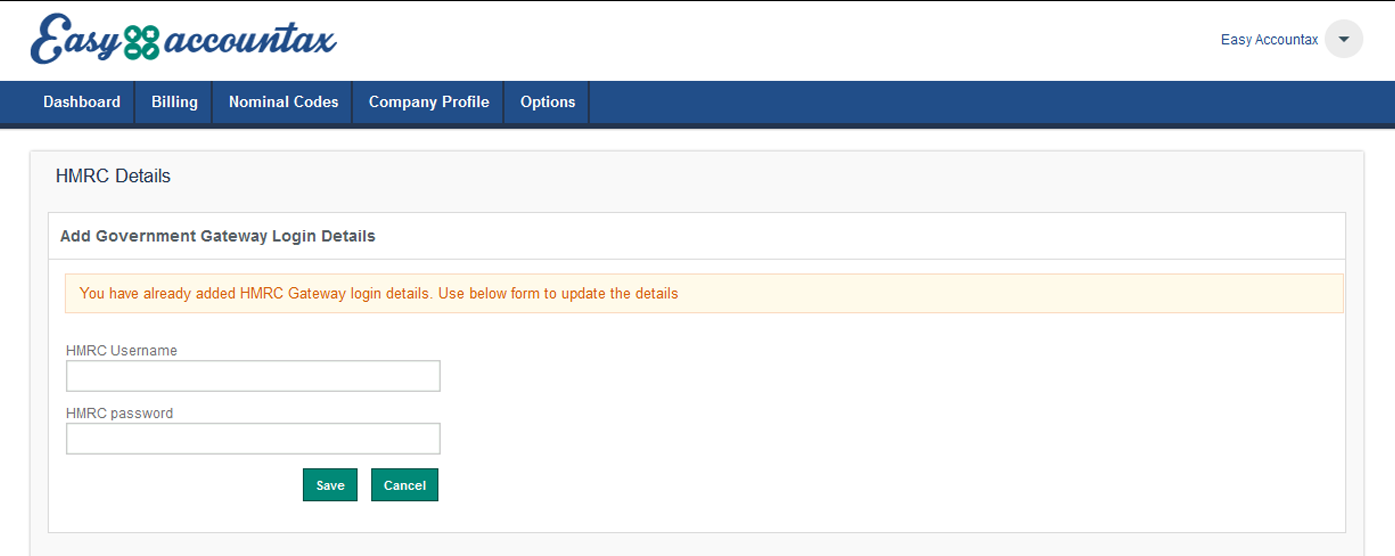

Where do I view my HMRC Statement? MalgraBooks Knowledge Base

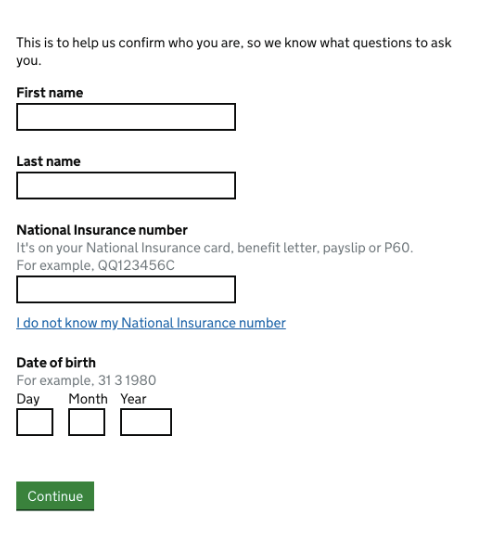

How to recover your HMRC login user ID TaxScouts

How to login HMRC Account A StepbyStep Guide 2024 YouTube

HMRC CIS Login Ultimate Guide Accotax

HMRC Login Login HMRC Easily with our Infographic

Hmrc Login

You Can Use Your Hmrc Business Tax Account To:

The Personal Tax Account Is Designed For.

You Can Use Your Online Tax Services To Complete Tasks Like.

Free Company Information From Companies House Including Registered Office Address, Filing History, Accounts, Annual Return, Officers, Charges, Business Activity

Related Post: